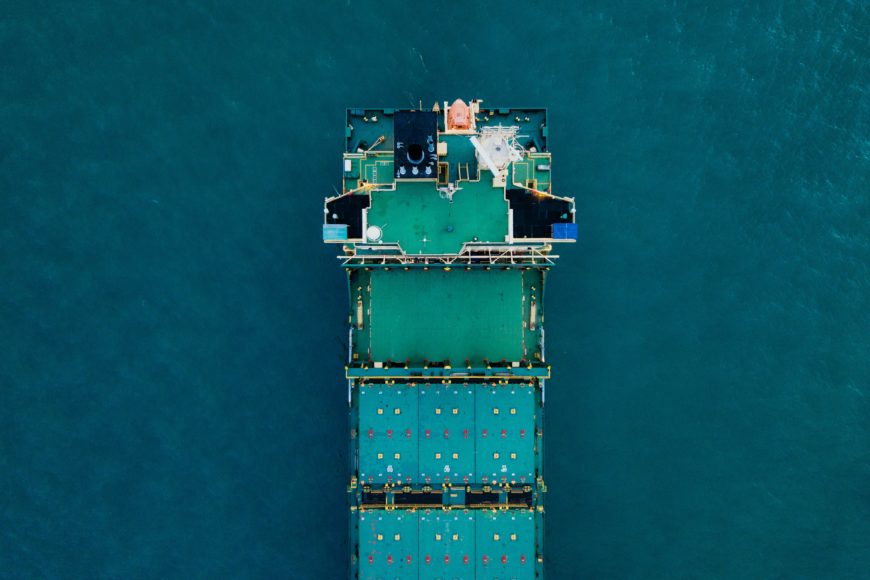

Tank

The positive development in the tanker market continued last week with increasing rate across the segment. The average rate for both Suezmax and Aframax increased, while VLCC developed sideways. The latest development in the spot market shows that the market is very sensitive at the moment, where minor changes in the demand makes a big difference for the rates. This is caused by a flat to negative vessel growth and we expect to see a good last quarter.

The rate development contributes to an increase in prices on the long-term contracts, since more and more tenants are in need for vessels in their books. The desperation spreads amongst the oil companies who are missing vessels for 2019, something that will continue to push the rates up.

Aframax – 12 months charter rate: $17.000 per day

Aframax – Average rate in the spot market: $26.000 per day

Dry Bulk

Baltic Dry Index fell 10,1% last week and closed at 1.031 points. The rates for Panamax fell 2,9% to $11.622. Unlike the tanker rates, the rates for dry bulk fell drastically the last weeks. It is primarily the larger vessels that have experienced large earnings decline, and the smaller vessels´ earnings has stayed above the break-even levels.

Despite the latest development, the average for BDI is still more than 18% above 2017. It is therefore, without a doubt, a positive long term trend we are in.

Capesize 12 months charter rate: $15.250 per day

Panamax 12 months charter rate: $12.500 per day

S&P

The secondhand market for tankers have improved radically the last weeks, with increasing buying interest and will to pay. Last week, more interesting transactions was executed.

2x 2007 Aframax models on 116.000 dwt was traded for $20 and $20,2 million. This Korean vessel has to perform its <

These prices shows an increase from former transactions and is caused by the better rate conditions in the market with the expectations of solid earnings the coming years.

In the drybulk market, there were also transactions last week, amongst them 2x Kamsarmax. The vessels are Chinese build in 2012 and 2019 and the prices are $18,2 and $30 million respectively. With other words, the prices are staying put, despite the recent negative rate sentiment.